Stop Laundry Tax

CLA Advocates for Laundry Owners’ Tax Rights

For more than 30 years, CLA’s top legislative priority has been to protect the exemption from sales tax enjoyed by the self-service laundry industry in most states.

CLA expertise has helped laundry owners save thousands of dollars each year by making legislators understand why laundries should remain exempt. By capitalizing on our strength in numbers, CLA has utilized our members’ resources and influence to protect our interests.

Social and Economic Benefits of Sales Tax Exemption

The median household income of a typical self-service laundry customer is $23,000 per year. Failing to exempt self-service laundry services from the sales tax is regressive and puts these individuals at risk of coming into contact with disease-causing bacteria and viruses because they cannot afford to wash their clothes, towels and bedding. Because of this, and the numerous economic and tax policy arguments for exempting these services, nearly all states exempt self-service laundry services from their sales tax.

Sales tax exemption for self-service laundries is an important tax provision that has far-reaching social and economic benefits. The CLA is committed to ensuring that all self-service laundries remain exempt from sales tax based on several fundamental principles of tax policy and to advance the health and financial security of families in our communities all across the United States.

Together, we can keep the laundry industry fair and profitable for all.

Sales Tax Resources

Use this flyer to share with your network or legislators the key reasons for exempting self-service laundries from sales tax.

Why Laundries Should Remain Exempt from Sales Tax

- Sales tax exemptions for self-service laundries protect the financial security of low-income working families and other vulnerable populations. Taxing self-service laundry services is regressive. Self-service laundries serve low-income renters, senior citizens on fixed incomes, students and others who cannot afford to purchase washers and dryers on their own. The median household income of a typical self-service laundry customer is $23,000 per year. Applying sales tax on these transactions is a regressive tax that isn’t paid by wealthier individuals who can afford to purchase a washer and dryer for their own homes.

- Self-service laundry provides a basic public health service. Clean clothes are a necessity, not an optional or luxury service. Failure to regularly wash clothing, bedding and towels can cause the growth of disease-causing viruses and bacteria, threatening the health of those that come into contact with the unwashed fabrics. Families visiting their local laundry each week rely on these services for the health and safety of their families. Increasing the cost of these laundry services will make it more difficult for families to afford this basic necessity.

- Sales tax on self-service laundry is fundamentally unfair and creates tax disparity between two similar actvities. Those members of the community who can afford home laundry equipment do not pay sales tax to wash their clothes. There is no justification for imposing sales tax on the work people do for themselves at a self-service laundry facility, while simultaneously exempting a similar service people do for themselves in a different, private location (their homes). The coin laundry industry simply makes the equipment and utilities—which have already been taxed—available to their customers who provide the labor on a self-service basis.

- Requiring sales tax collection from self-service laundry consumers would force laundry owners to purchase new equipment or pay for expensive upgrades to perfectly functioning existing equipment. Because many self-service laundries accept payments by quarters only, taxing self-service laundry services would require either an additional 25 cents of tax (substantially increasing the end-cost of the service) or for the purchase new equipment to accept final costs in non-25 cent increments (an unnecessary and high-cost expense for business owners).

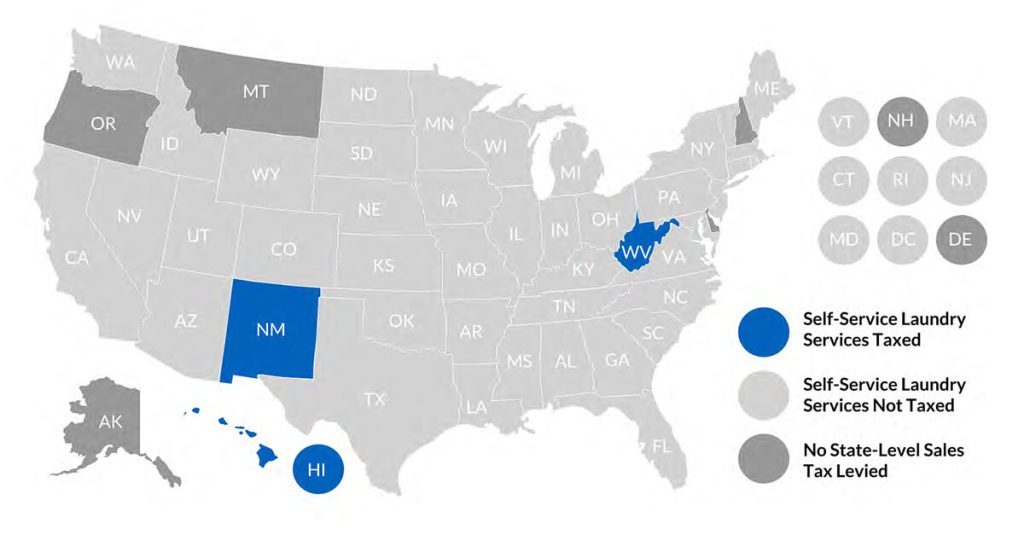

- The majority of states exempt self-service laundry from their sales tax. 42 out of 45 of the states that levy a general sales tax exempt self-service laundry from the tax. Only three states charge sales tax on self-service laundry (Hawaii, New Mexico and West Virginia). Repealing the exemption would make the state out-of-step with others.

- Sales tax on self-service laundry results in double taxation. Taxing self-service laundry services leads to what is known as “tax pyramiding,” where taxes pile up on one another as a product or service moves from the provider to the final consumer. Operators of self-service laundries already pay sales tax upon purchase of their equipment, despite the fact that economists across the political spectrum agree that business inputs should be exempt from tax because of the negative economic effects of tax pyramiding. These taxes are already embedded in the price of self-service laundry, and removal of the self-service laundry exemption would result in an additional sales tax on top of an already-paid sales tax.

Ready To Join?

Protect your business by becoming a CLA member.